Our team is happy to solve your query. Fill the form and we will get in touch with you.

Our team is happy to solve your query. Fill the form and we will get in touch with you.

LUT ( Letter Of Undertaking )

gstnumber@popcorninfotech.com

Helpline

8767003366

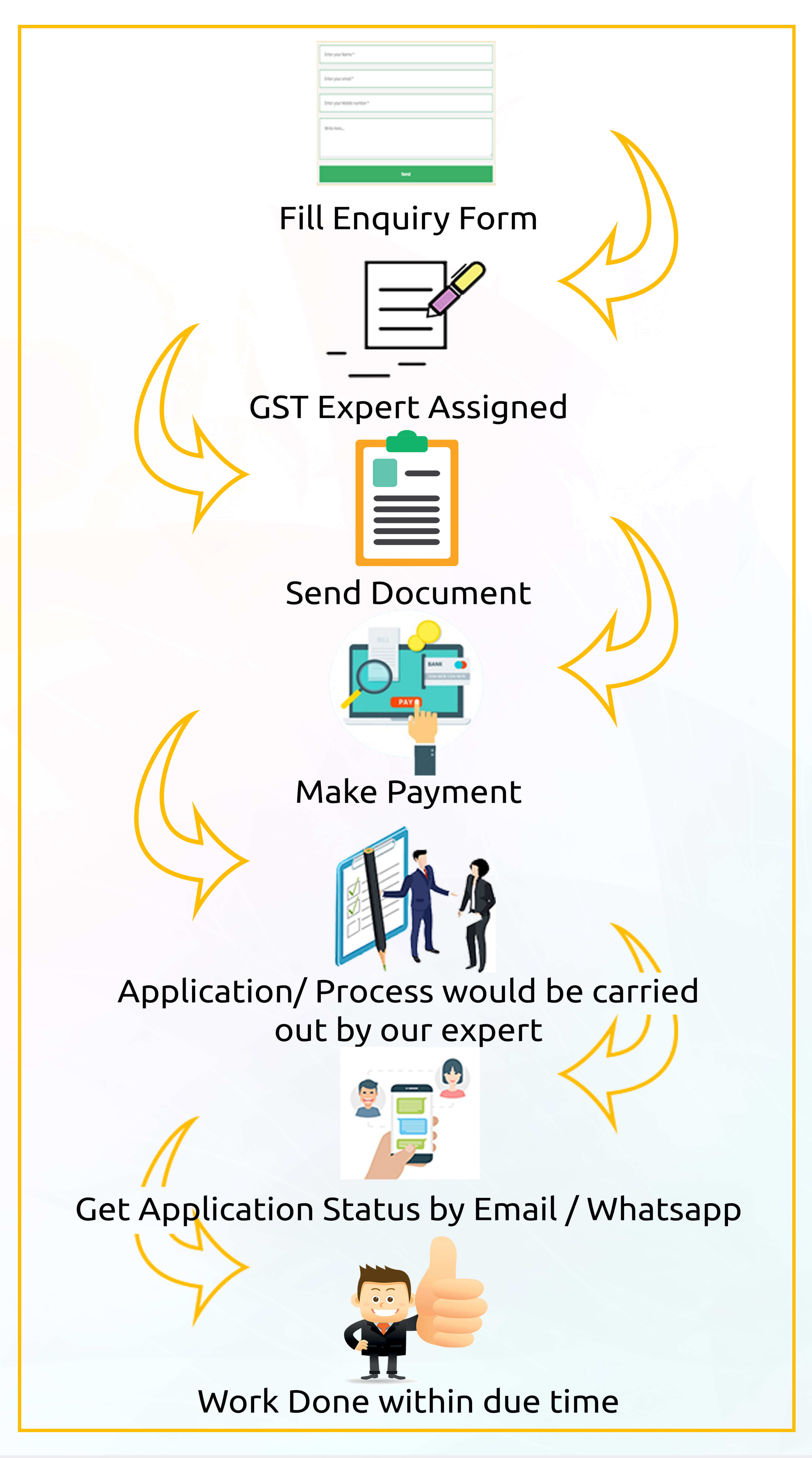

While exporting goods or services, the exporter has an option to either pay IGST on exports and then claim refund of GST paid amount, or furnish Letter of Undertaking (LUT) and sell without payment of GST

LUT is prescribed to be furnished in form GST RFD 11 under rule 96A, whereby the exporter declares that he/she would fulfill all the requirements prescribed under GST while exporting without making IGST payment.

| Export without IGST (under LUT) | Export under IGST (without LUT) | |

|---|---|---|

| Sales Value | 100 (no GST) | 100 + IGST = 118 |

| Purchase Value | 80 + 18% GST = 94.40 | 80 + 18% GST = 94.40 |

| GST Paid to Govt. | Nil | 18-14.40 = 3.60 |

|

|

|

Note: *Popcorn Infotech Provides FREE Franchise ( I.e. Charges NO Franchisee Fee) with Requirement of Initial Wallet Balance to Be Paid Upfront