Sole Proprietorship / Individual

(1) Name of Business

(2) Nature of Business

(3) PAN card

(4) Aadhaar card

(5) Photograph

(6) Bank statement or cancelled cheque

(7) Office address proof :

~ If Owned Premises – Copy of latest electricity bill OR Property tax paid receipt OR Municipal khata Copy

~ If Rented Premises – Valid Rent Agreement

– Copy of latest electricity bill

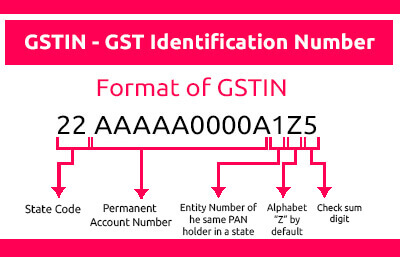

More than one GSTIN can be taken on a single PAN. For instance, when an entity has business in multiple states, it can take GST registration in each state.

A business may have business verticals i.e. distinguishable components engaged in business activities different from each other. In a single business there can be a manufacturing and trading units which can be considered as business verticals.

In this case, more than one registration can be obtained even when the Head Office and branches are located in the same state.

An offender not paying tax or making short payments (genuine errors) has to pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10,000.

The penalty will at 100% of the tax amount due when the offender has deliberately evaded paying taxes.

- Registration

- Only Registration

- INR 999 /

Taxes Applicable - GSTIN Application

- GSTIN Certificate

- -

- Regular reminders and updates about upcoming Due Dates

- Phone, Whatsapp & Email Support

- BUY NOW

- Registration + Filing

- Quarter Package

- INR 2479 / Taxes Applicable

- GSTIN Application

- GSTIN Certificate

- 3 Months GST Return Filing

- Regular reminders and updates about upcoming Due Dates

- Phone, Whatsapp & Email Support

- BUY NOW

- Registration + Filing

- Bi-Annual Package

- INR 4479 / Taxes Applicable

- GSTIN Application

- GSTIN Certificate

- 6 Months GST Return Filing

- Regular reminders and updates about upcoming Due Dates

- Phone, Whatsapp & Email Support

- BUY NOW

- Registration + Filing

- Annual Package

- INR 7999 / Taxes Applicable

- GSTIN Application

- GSTIN Certificate

- 12 Months GST Return Filing

- Regular reminders and updates about upcoming Due Dates

- Phone, Whatsapp & Email Support

- BUY NOW

Note: *Popcorn Infotech Provides FREE Franchise ( I.e. Charges NO Franchisee Fee) with Requirement of Initial Wallet Balance to Be Paid Upfront